Tax Assessment

Duties of the County Assessor

The County Assessor is the official responsible for listing and assessing all Real Estate and personal property for Ad Valorem (property tax) taxation. In the words of the North Carolina Machinery Act, (property tax laws) this official's duty is to "have general charge of the listing, appraisal, and assessment of all property in the county in accordance with the provisions of law." To this end, the statute provides that the assessor "shall have and may exercise all powers reasonably necessary in the performance of his duties not inconsistent with the Constitution and laws of this State."

What the Assessor Does

The Assessor evaluates all property subject to taxation. The Assessor is required by North Carolina law to list, appraise and assess all property within the county at 100% of market value. In addition to the over 65,000 parcels of real property (land, homes, commercial buildings), the Assessor must value business personal property of approximately 4,500 businesses, ranging from multi-million dollar enterprises to one person operations, there are over 10,000 manufactured homes, over 100 aircraft and over 4,000 watercraft, and any other personal property which is taxable. There are over 100,000 motor vehicles which are billed monthly. The Assessor's Office creates over 180,000 tax notices annually.

The Assessor Does Not

The Assessor does not make the laws which affect property owners. The North Carolina Legislature makes the tax laws. The Henderson County Board of Commissioners, the governing bodies of the City of Hendersonville, Town of Fletcher, City of Saluda, Town of Mills River, Village of Flat Rock and the Town of Laurel Park determine their budgetary needs and set their own tax rates to meet that budget obligation.

The Assessor determines the property worth based on market value.

The Assessor does not determine taxes.

What is Taxable Value?

In NORTH CAROLINA, Taxable value is Market value. The Assessor must use the methods prescribed by North Carolina General Statute. 105-283 Uniform Appraisal Standards.

..."All property, real and personal, shall as far as practicable be appraised or valued at its true value in money. When used in this Subchapter, the words "true value" shall be interpreted as meaning market value, that is, the price estimated in terms of money at which the property would change hands between a willing and financially able buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of all the uses to which the property is adapted and for which it is capable of being used. For the purposes of this section, the acquisition of an interest in land by an entity having the power of eminent domain with respect to the interest acquired shall not be considered competent evidence of the true value in money of comparable land."...

How Does The Assessor Determine Tax Value?

Property values change over time and must be adjusted periodically to maintain balance and equity. To ensure that balance and equity are maintained, the State of North Carolina requires real property be reappraised on a cycle that maintains and acceptable Assessed Value to Sales Price Ratio (90% to 110%), (Assessed Value divided by Sales Price) and that the cycle not does not exceed eight years.

Real Estate values shall reflect the market value of properties at the time of the last reappraisal. Real property values usually increase over time; however, not all properties increase at the same rate and even some property values may decrease in value. Due to these changes occurring, a reappraisal process is necessary to reflect market value and maintain equity and balance. Because there is such a volatile real estate market, Henderson County has opted to maintain a four-year reappraisal cycle. Click here to read about Reappraisal

How Are Taxes Calculated?

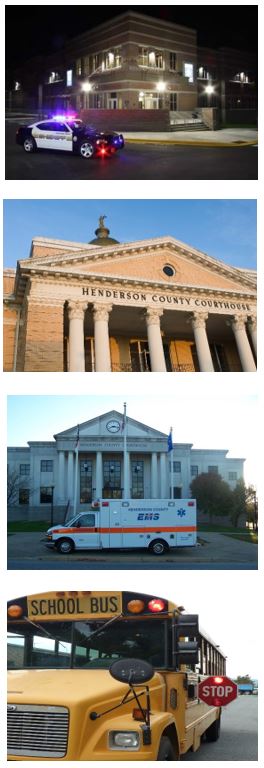

In Henderson County, there are currently 22 tax districts, including General County. The tax rates for these districts are based on the amount of monies budgeted to them for the necessary maintenance and improvements of their facilities and services. The tax monies collected for the districts pay for schools, police and fire protection, along with the other services that a taxpayer demands and desires from your local government. These tax rates vary depending on the type of services provided to any designated area.